Fixed expenses are those that don’t change for the foreseeable future.

#Are taxes periodic expenses free#

Free Tour (opens in new tab) Log In Products.

#Are taxes periodic expenses how to#

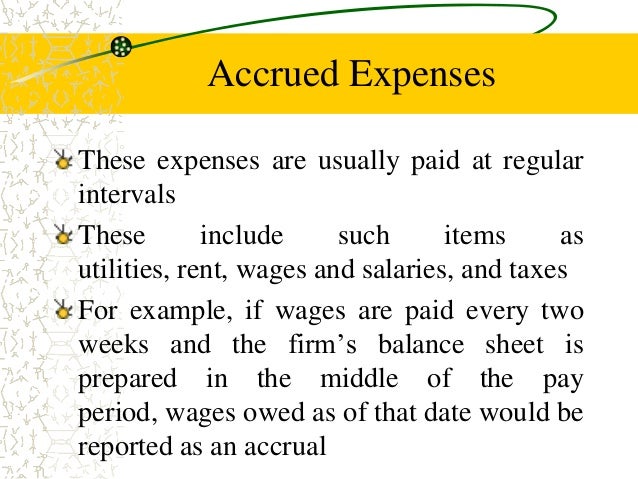

There are no guarantees that working with an adviser will yield positive returns. Here are the most common small business expense categories that count as a tax-deductible business expenses, what makes them small and ordinary, and how to track them. See this link for expenses you can deduct. Meals may be estimated using federal per diem rates. Temporary living expenses include hotel lodging (or apartment rent for longer stays), meals, and local transportation. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). The expenses may only be claimed for a stay for business. There are three kind of expenses: Fixed, Periodic and Variable. Objectivity in the calculation of periodic expense. Matching of periodic expense to periodic revenue. All investing involves risk, including loss of principal. 109, Accounting for Income Taxes, justification for the method of determining periodic deferred tax expense is based on the concept of. This is not an offer to buy or sell any security or interest.

We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. SmartAsset does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments. Fixed costs include any number of expenses, including rental and lease payments, certain salaries, insurance, property taxes, interest expenses, depreciation. maintenance payments, certain healthcare costs, study expenses and. SmartAsset’s services are limited to referring users to third party registered investment advisers and/or investment adviser representatives (“RIA/IARs”) that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. periodic payments (such as annuity or maintenance payments). Securities and Exchange Commission as an investment adviser. Speaking of expenses, you will have to analyze your three budget expenses, namely fixed, variable, and periodic expenses. period beginning in the tax year in which you incurred the costs. SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. taxes or as business expenses, but are depreciable capital expenses.

0 kommentar(er)

0 kommentar(er)